Are you working towards a financial goal? Perhaps you want to save money to pay for a dream vacation, an extension, or a new car. Maybe you want to pay off your student loan or other debts. Do you want to have more cash in the bank for more security or is it time to grow your business from 5-6 figures - and beyond.

Money may not make you happy, but it does create more choice. It’s why so many people set themselves financial goals - and on the surface, they’re easy to achieve! All you have to do is one of these three things:

- Earn/generate more money

- Spend less money

- Or a combination of the two

Of course, the reality is more complicated than that. Financial goals require you to change your habits, shift your beliefs, and commit to difficult actions. You’ll need to cultivate discipline and grit as well - to ensure you stay the course all the way to the finish line.

So regardless of the top-line strategy you pick, you’ll need a tool to help you plan your actions, track your progress, and reflect on your performance. You need a tool that keeps your goal top of mind and hold you to account - especially when the journey gets tough.

It’s why you need a Self Journal. Let me explain…

What is the Self Journal

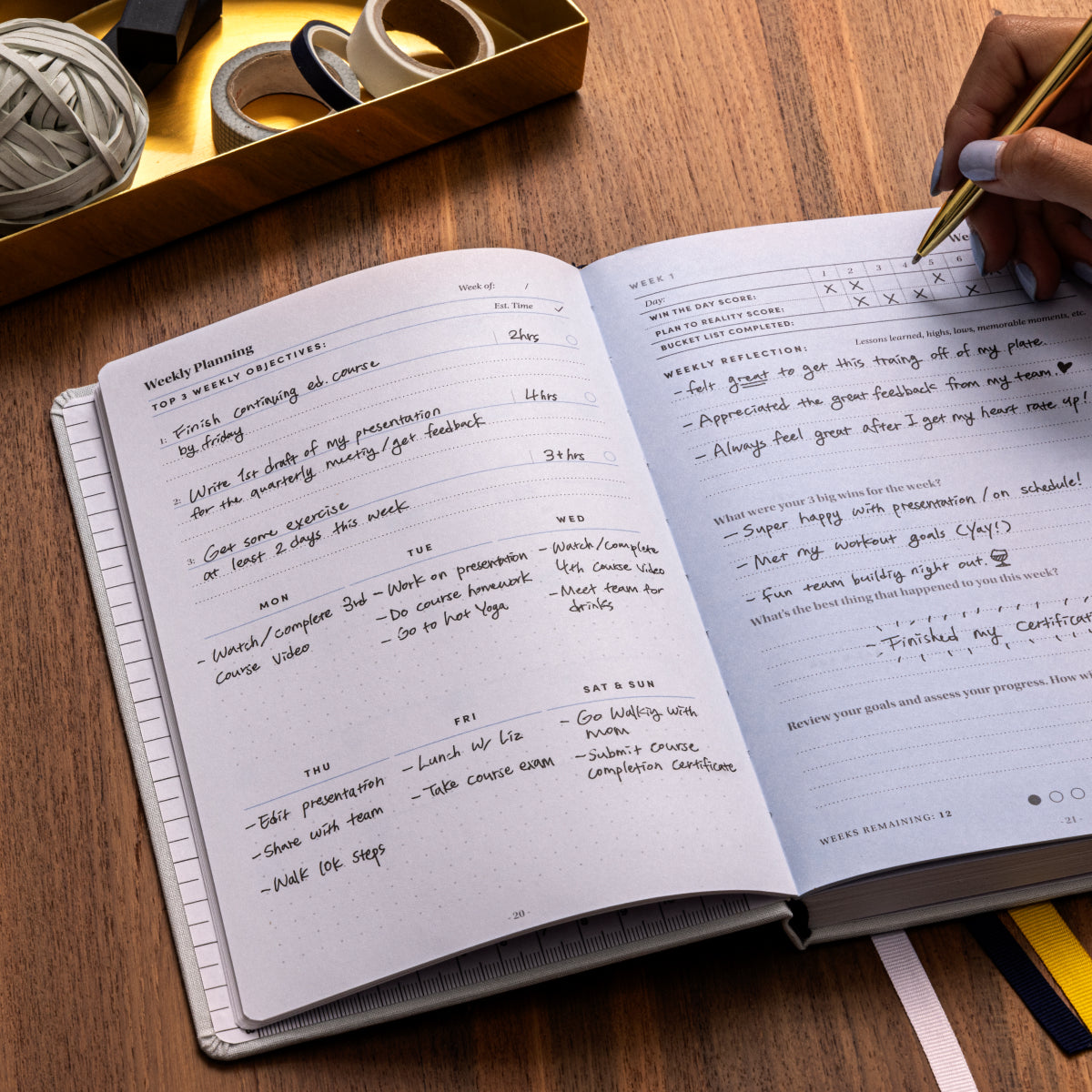

The Self Journal is the high-performance planner that combines productivity with positivity. Based on science, this planner provides the structures that help you take control of your life and achieve your goals.

With the Self Journal, you can plan your day to prioritize the actions that lead to success. For example:

With a Self Journal in your hands, you can mastermind the path to your goals - instead of making up the steps as you go along. With a clear plan of action, you’re more likely to stay the course and succeed.

These are the steps to take.

Step 1. Set a SMART Goal

If you want to achieve a financial goal you have to set the right goal. This is a non-negotiable. Science says 92% of people don’t achieve their goals and a core reason is because their goals aren’t SMART.

Instead of getting super clear on the desired outcome, they say something flimsy such as: “I want to save money” or “I want to get out of debt”. These statements are intentions, they not goals because they aren’t:

- Specific

- Measurable

- Attainable

- Relevant

- Time-based

Making your goal SMART increases your likelihood of success because you know what success looks like for you. As a result, you have a clear target to hit which keeps you focused and motivated. Look at the difference:

Each of these goals detail a specific target (S) that can be measured (M) and a clear deadline (T).

You know when you’ve crossed the finish line and you know how quickly you have to work. More importantly, these ‘restrictions’ create a framework in which you can mastermind your plan of attack.

This is where A (attainable) and R (relevant) come in.

It’s good to set a stretching goal. When we’re pushed out of our comfort zone we can always do more than we believe is possible. But don’t make your target so stretching that it’s no longer realistic. If you set yourself up to fail, you’ll struggle to drum up the motivation you need to keep going.

In addition, check the relevancy of your goal. Do you care enough about the target you’ve set? Does this goal take you in the direction you want your life to go? If you don’t have a big enough why, you won’t cultivate the grit and determination needed to succeed.

With your SMART target defined, you can start to complete your Self Journal 13-Week Roadmap (it’s on page 4).

Write your SMART target into the RESULTS GOAL section.

Step 2. Define your progress goals

With a SMART target set, you’re now clear on the finish line.

But how will you get from where you are now to where you want to be? Success rarely happens overnight. Instead, success is the cumulative effect of consistent daily action - and there will be a number of milestones along the way.

It’s a little like climbing Mount Everest. While the peak is the ultimate destination, climbers concentrate on each stage at a time. Chunking down your goal into more manageable steps makes the ultimate goal feel less overwhelming. And when you’re not overwhelmed, it’s a LOT easier to focus and keep the needle moving.

So your next step is to figure out your equivalent PROGRESS GOALS for your financial targets.

What big milestones will you pass along the way?

What is your strategy for achieving your goal? When you’ve figured out your plan of action, create your progress goals and add them to your 13-Week Roadmap.

Step 3. Define your Actions and Tasks

Where your RESULT and PROGRESS goals help you to stay on a straight line, your tasks and actions focus on the nitty gritty of what you need to do on a daily basis.

Let’s return to our savings goal:

What do you need to do on a daily/weekly basis to hit these targets? Time to brainstorm. For example, you could:

If you add up the savings from all the above, it’s surprising how much you can accumulate.

Consider the one-offs as well, for example:

The key is to examine your lifestyle and your budget to explore the opportunities that exist to spend less and save more. You can get really creative with this.

What actions and tasks are you committed to? Write them on your 13-week Roadmap.

Step 4. Plan your time

With your goal set, your milestones laid out, and your actions and tasks identified, your next step is to plan your life to make it all happen.

Your Self Journal contains everything you need to do that:

Time is your most valuable, non-renewable resource. If you can figure out how to spend it well, you’ll be able to get a lot more done. Plan your time to account for every minute, and this is where you free up the time to do the extra tasks and actions that will close the gap to your goal.

Step 5: Adopt new, empowering habits

What you achieve is the sum of your habits. The problem is that we are creatures of habit! In other words, it’s not always easy to break free of ‘bad’ ones and embed more empowering ones.

But that’s exactly what you need to do if you want to achieve your financial goals.

Once again, the Self Journal can help with its weekly Habit Tracker. Simply note the habits you want to track (and how many times a week you want to do them). Check off your success and watch your chain of wins grow.

Repeat your new habits long enough and they’ll soon become second nature.

Self Journal Success Stories

Anything is possible with the right plan and the Self Journal contains a proven system that will help you close the gap from where you are now to where you want to be.

Do you have a financial goal you want to achieve?

If so, grab yourself a Self Journal and use it to mastermind your path to success.

Leave a comment

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.