2021 has arrived, and the new year is the perfect excuse to reevaluate your life and set goals, especially when it comes to your finances. In fact, a 2020 survey on new year’s resolutions showed that out of Americans’ 2020 resolutions, 49% wanted to save more money and 30% wanted to stick to a budget.

That said, it’s time to make your finances a priority. If you want to save money, rethink your spending habits, and take charge of your money in the new year, read on to find out what you can do to achieve your financial goals.

1) Cut back monthly bills

Between your wireless, phone, and streaming services, the amount of monthly expenses can become overwhelming. Factor in rent, car payments, or a mortgage, and it becomes even more important to reassess which of your bills you could live without.

Eliminate expenses you don’t need or substitute with cheaper alternatives. If there aren’t any services you can part with, reduce monthly bills by eating in and cooking meals in bulk so you spend less on dining out. Find a cheaper gym or work out at home. Use less electricity. Utilize refurbished or recycled materials whenever you can. Take a look around and decide what lifestyle changes you can make to save money this year.

2) Look into refinancing

Another way to cut back on your monthly expenses is to lower or refinance the loans you currently have. You can do so with your student loans or with your mortgage, depending on your situation. With refinancing, your current loan is paid off and replaced with a new one with different terms, oftentimes lowering your monthly payment.

While refinancing sounds like a great idea, it is not ideal for everyone. Refinancing a mortgage in particular comes with many associated costs like appraisal fees, taxes, and insurance payments. So, it’s important that you learn what really goes into refinancing to see if your bank account and your lifestyle can support this venture.

3) Put more into your retirement fund

This is an example of something you can do in the present that will benefit you greatly in the future. Contributing a certain percentage of your monthly salary into your company’s 401k program will help you earn essentially free money, so if you haven’t started yet, this is an opportunity worth pursuing.

Put a comfortable percentage of your salary into your retirement fund– start by contributing up to 10%, depending on your other commitments. The fewer financial obligations you have, the higher the percentage should be. However, any amount can give you a comfortable lifestyle in your later years and will make the decades of hard work worth it. Many employers will match a certain portion and allow several different types of investments. Talk to your employer to find out what you can do to take advantage of your 401k.

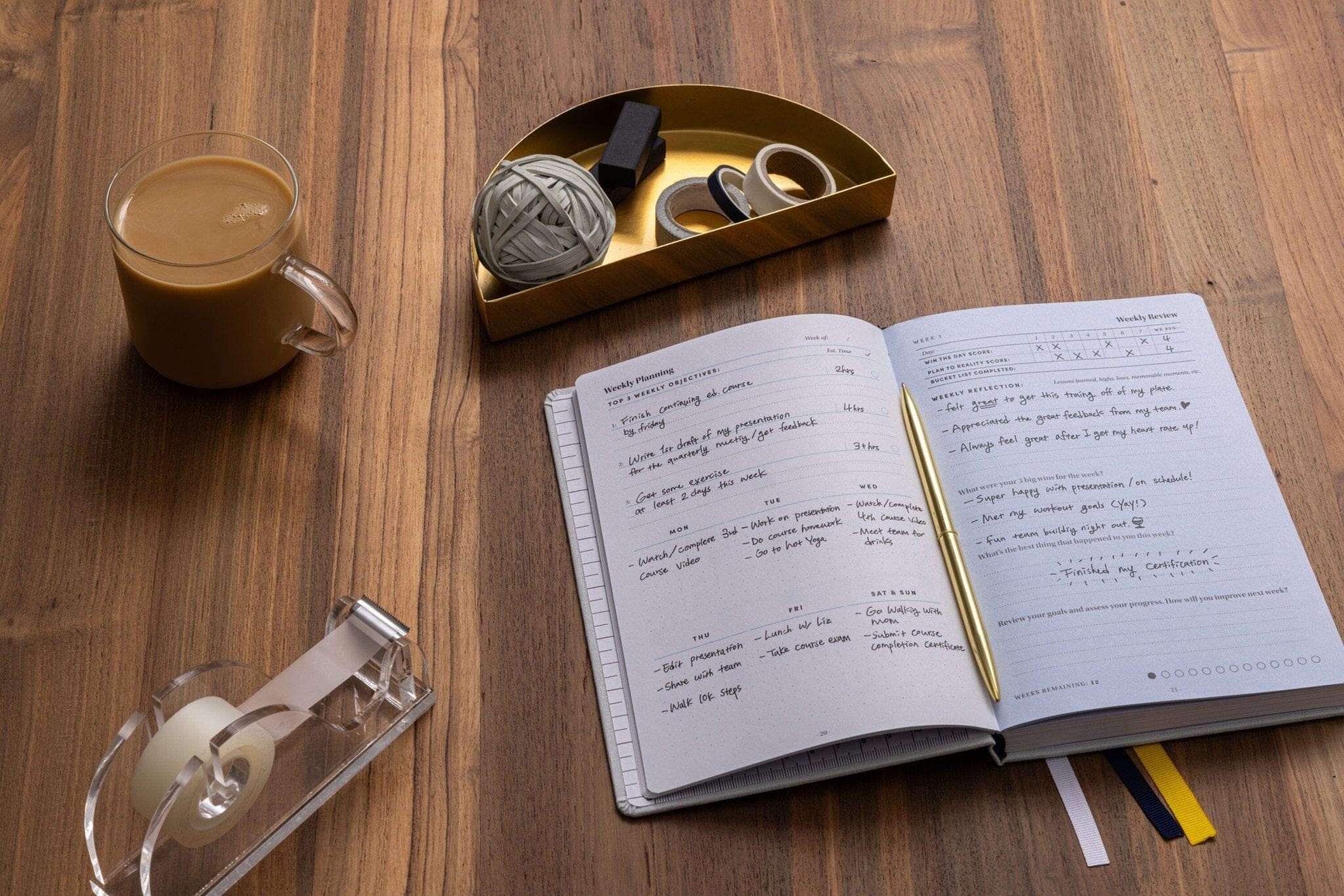

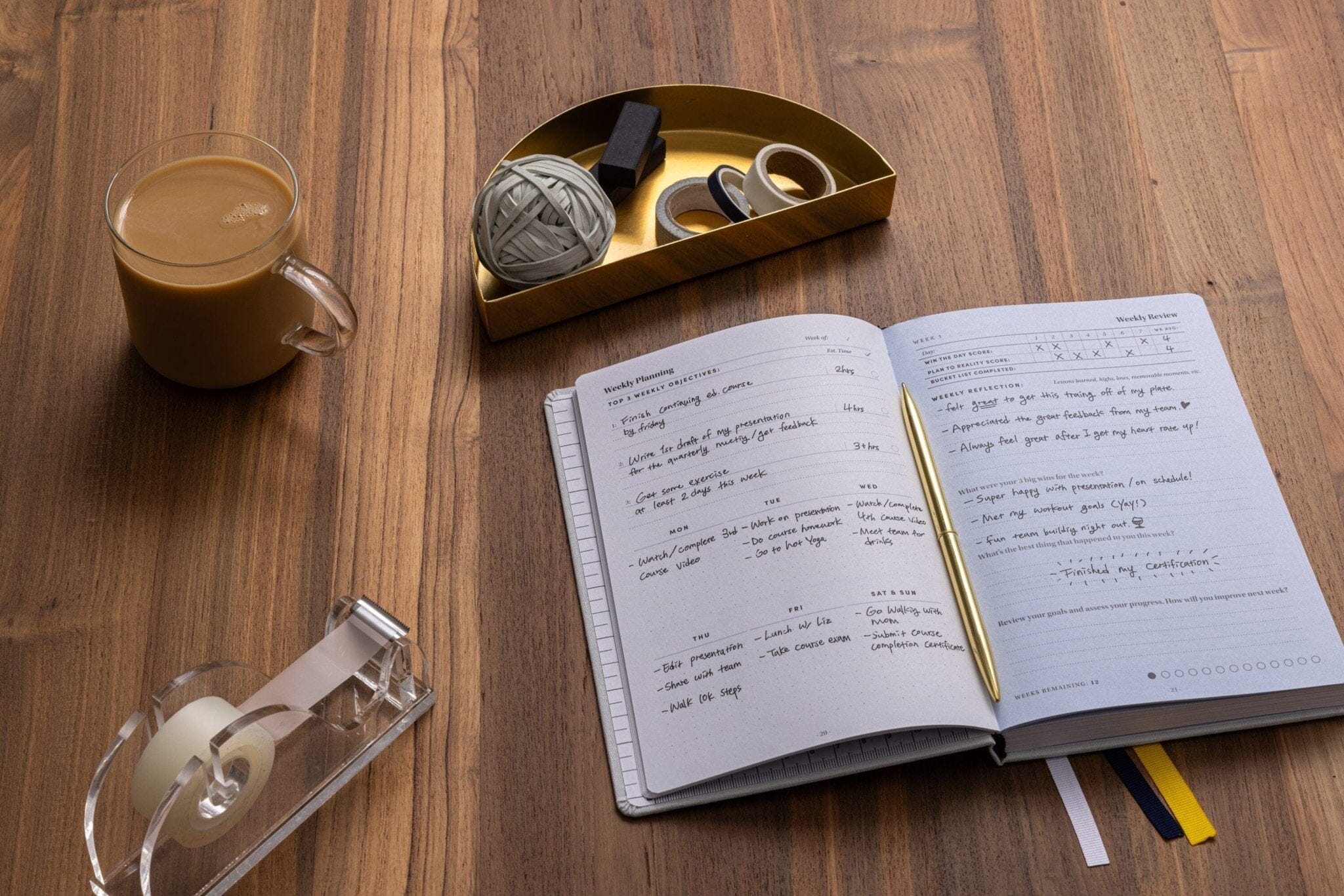

4) Develop your professional skills

While this might not be the first thing to come to mind when talking about ways to take charge of your finances, it is perhaps one of the most impactful. While a lot of monthly expenses are unavoidable, improving your talents at work is well within your control, allowing you to take the reins on your own professional and financial future.

Take the initiative to further your own career by taking on extra projects, voicing new ideas, and learning from your peers. Stand out amongst your coworkers and find out what you can do to put yourself first in line for professional advancement. Gaining more knowledge, skills, and experience helps you become more eligible for promotions, and in turn, raises– which means more money in your wallet at the end of the day.

Take control of your life in the new year by taking charge of your money. Acquire better spending and saving habits, and learn new ways to be financially savvy in 2021!

Disclaimer! This blog does not constitute financial advice. Always check in with a financial advisor or coach to get advice tailored to you.