Economic growth is a fascinating area for anyone keen to understand how societies progress. For many years, economic growth journals have served as vital tools for capturing and analyzing trends within economies. These journals compile crucial data, offering insights into how and why economies expand or contract. By studying these patterns, analysts and enthusiasts can predict future trends and make informed decisions. The significance of these journals lies in their ability to reflect complex economic activities, breaking down intricate data into understandable nuggets of information.

At the heart of it, economic growth journals are like detailed reports that narrate the story of an economy. They collect various indicators, such as GDP, inflation, and employment rates, to provide a snapshot of economic health. For those keeping an eye on market trends, these journals offer a condensed view of how different factors contribute to growth or recession. With their comprehensive data, they help readers identify patterns that, in turn, shed light on potential opportunities or pitfalls in the market landscape.

Understanding Economic Growth Journals

Before diving into how patterns can be recognized, it's essential to understand what economic growth journals are about. An economic growth journal typically compiles statistical data, reports, and analyses that capture the direction in which an economy is headed. Think of it as a detailed economic diary that notes everything from employment rates to currency values. These journals serve the purpose of informing policymakers, businesses, and researchers about the current economic climate and likely future scenarios.

The primary aim of these journals is to track and analyze growth trends. By examining how various factors influence the economy, these journals outline potential areas of improvement or concern. For example, if a country's GDP is decreasing while unemployment rates are soaring, the journal would detail what could be causing this shift. This information then helps decision-makers craft strategies geared toward improving economic conditions.

Key Indicators in Economic Growth Journals

To make sense of any economic growth journal, one needs to understand the indicators used. These indicators act as signposts, guiding readers through the economic landscape. Some common ones include:

1. Gross Domestic Product (GDP): This measures the total value of all goods and services produced over a specific period, offering insight into economic health.

2. Inflation Rates: Keeping tabs on inflation helps assess the purchasing power and stability of a currency.

3. Employment Statistics: High employment often signals robust economic activity, while unemployment may indicate underlying issues.

These indicators play a crucial role in analyzing economic growth. By piecing together data from these metrics, one can identify whether an economy is on an upward trend or veering off course. Understanding these metrics equips readers with the tools necessary to make sense of economic growth journals and prepare for potential challenges or opportunities ahead.

How to Recognize Patterns in Economic Growth Journals

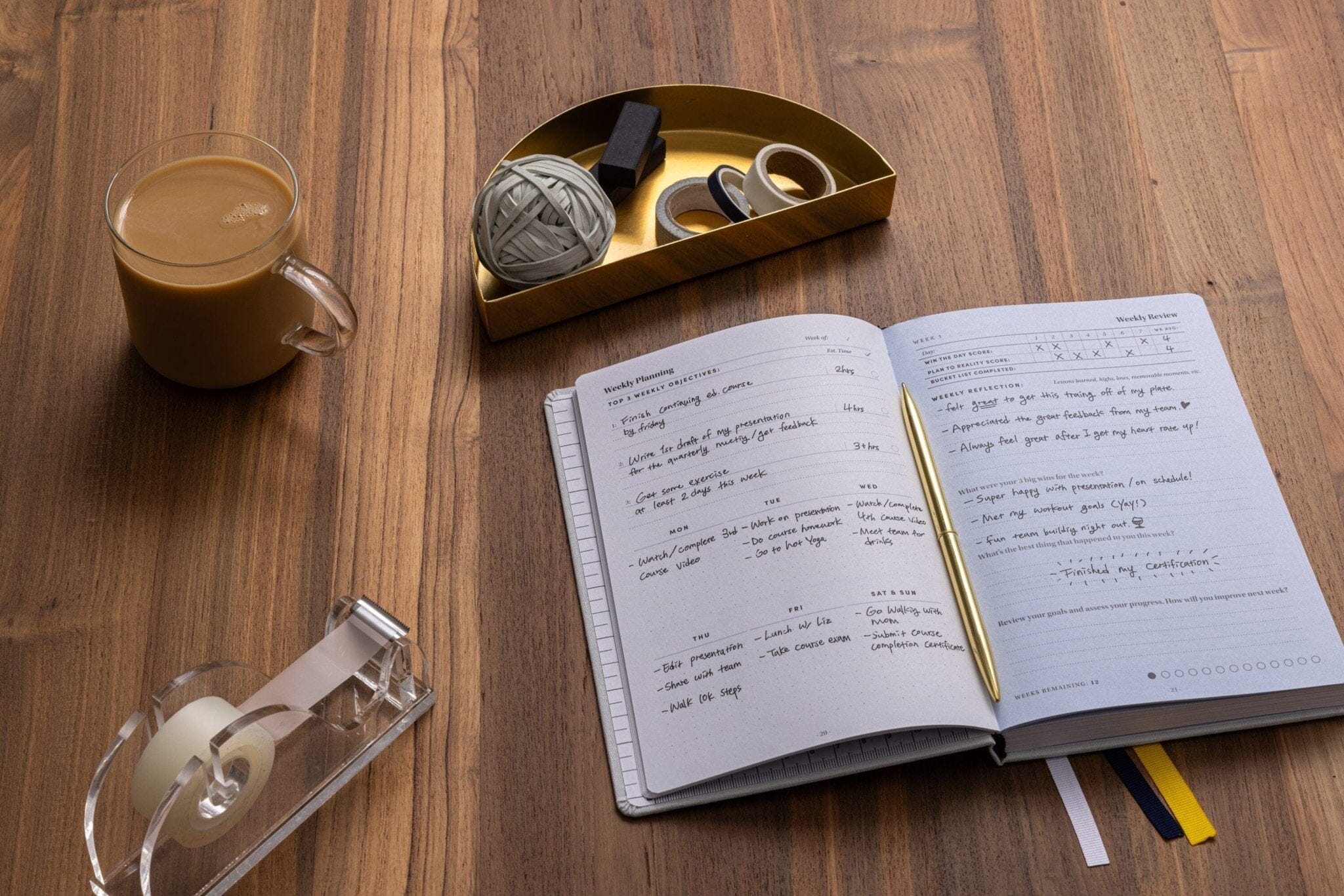

Spotting patterns within economic growth journals can feel challenging at first, but by taking a structured approach, it becomes easier. A good start is to look for repeated economic behaviors over certain periods. For instance, seasonal trends might reveal that certain industries, like retail, thrive during specific months due to holidays or events. Similarly, cycles such as economic booms and busts often repeat, offering clues based on historical data. By aligning these patterns with external factors, such as political changes or international trade developments, one can form a more comprehensive understanding.

Consider this example: if employment statistics indicate a rise in seasonal jobs during summer, you might predict an increase in consumer spending during this time as well. Conversely, noticing a pattern of rising inflation rates may suggest that costs of goods are increasing, possibly impacting purchasing power. Comparing present figures with past trends can unveil noteworthy insights about potential future outcomes. Recognizing these rhythms helps in crafting strategies to either capitalize on favorable conditions or navigate around potential downturns.

Practical Applications of Recognizing Economic Patterns

Being aware of these patterns isn't just for analysts; it holds practical value for businesses and investors alike. Businesses can adjust their strategies by leveraging these insights to pinpoint when to expand operations or when caution is needed. Investors can refine their portfolios by investing in sectors expected to grow based on recognized economic trends. For example, knowledge of past market booms can inform decisions about when to buy or sell assets, optimizing returns.

Here are some ways businesses and investors utilize economic patterns:

1. Strategic Planning: Understanding when certain industries typically perform well allows for better strategic planning. Companies might decide to launch new products during booming sectors or seasons.

2. Risk Management: By analyzing patterns that precede economic downturns, companies can implement risk management strategies, such as diversifying investments or controlling costs more tightly.

3. Investment Opportunities: Investors looking for opportunities can prioritize resources into sectors predicted to grow based on historical data, leading to potentially higher returns.

While these examples illustrate the benefits, they also underscore the necessity of staying attuned to continuous changes. This ensures that decisions factor in the latest economic developments and are rooted in reliable data.

Bringing It All Together

Recognizing patterns in economic growth journals is like piecing together a puzzle. Each indicator, pattern, and trend contributes to a clearer picture of the economic future. By understanding how these elements align and sometimes conflict, stakeholders can make smarter decisions. Whether it's planning a business expansion or tweaking investment strategies, the insights drawn from these journals provide a strategic edge.

As you explore economic growth journals, consider them a map guiding you through an often unpredictable economic landscape. With practice, the patterns you spot will become invaluable tools in predicting market shifts, helping not just in navigating the present but also in preparing confidently for the future. Keeping these insights in mind will empower you to not just react but to be proactive in fostering growth and success.

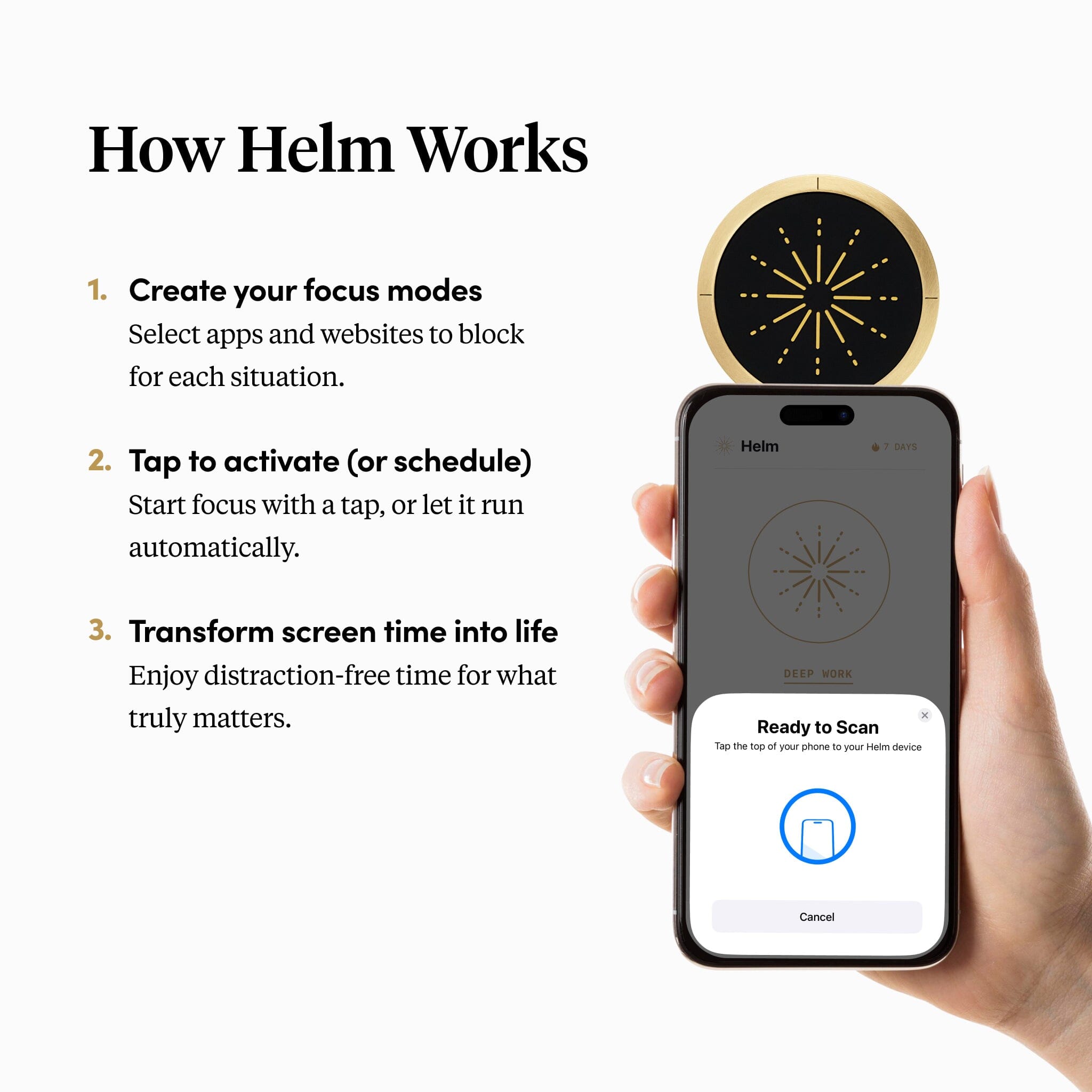

Bringing your understanding of economic patterns full circle can be a game changer in how you navigate opportunities and challenges. As you continue to explore and make informed decisions, drawing from insights in an economic growth journal can provide a strategic edge. For more resources to support your growth journey, visit BestSelf Co.’s collection on personal development tools and guides.